Top 10 Ways to Prepare for a Recession

Okay, it's pretty obvious that the United States of America is headed for a recession. While I don't want to cause this list to become a slugfest between Biden voters and Trump voters, it's a pretty good idea for a list, so I'm gonna give it all I got as far as quality, which means lots of research and details. Without further ado, here are ten ways to prepare for a recession.

It's an excellent idea to have an emergency budget already established and set in motion in case you lose your job. This will be of great assistance to you and make sure you do not need to do extra decision making, considering how you'd already be quite stressed out from getting fired. Planning on how you will minimize what would be your everyday spending under normal circumstances. You might also want to consider what areas of your budget you can do without as a whole, and where you can move your money around. Doing this will let you experience stress and allow you to pay more attention your mental health, which may not be the best, given the stress and anxiety.

Distinguishing your needs from your wants is very important when planning for hard times, as far as economics goes. Knee deep in a recession, you probably won't have money to spare for things you want, like a long awaited video game, or a manicure, since money, inventory and employment all have the potential to be scarce. By separating things you want, and things you need, you prioritize, and you will hopefully be more considerate, given dire circumstances, and look for things like food and gasoline before trying to collect CDs, buy a new cell phone, and so on. This is called minimalism, and the title speaks for itself when it is by definition what you would need to do in order to make sure that your inventory has necessities outweighing desires by a large margin.

Not a bad idea to do without a recession looming, but working on boosting your credit score to help brace yourself for a recession is pretty much a must do, because when times of trouble come, you will be abe to apply for a new credit card in order to keep yourself stable in a sinking economy. If you use a credit card to pay for various needs, as opposed to paper money, make sure that you eventually, if not immediately, can pay the minimum amount of credit card debt, and other required payments debts, like rent. Bad credit scores can make it quite harder to borrow years after you get them.

Even if you still have a job, spending money as if you are now on the unemployment line eliminates discretionary spending, and makes it so you can only focus on necessities, if you want to survive. And cutting down your spending on non-essentials is a great way to preserve money for when you do need something urgently. By changing your perspective to "I don't have a job anymore. I need to make sure I save as much money as possible." might give you a false sense of desperation, but it might also be what keeps as much money in your wallet as possible. More hard times may be lurking around the corner, for you and all your lived ones, so it's a good idea to limit how much money you are spending, to brace you for said hard times.

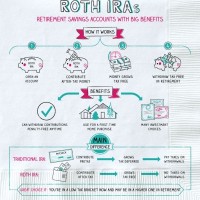

If you're taking into consideration stopping your 401k in order to help create an emergency fund, another approach is to invest in a Roth IRA, or an individual retirement account. Roth IRAs have somewhat flexible withdrawal limits for people in their 59 and one half or older. For instance, you can take out investments at whatever time you wish without you having to pay taxes or a ten percent penalty. It's still very important to invest in your employer in order to match your 401k, but making extra investments to a Roth IRA gives you more pliability.

You'd have to be very lucky to have been able to book such a checkup for when a recession is still looming, and is yet to hit. But it never hurts to try for that. If you schedule to see the doctor before a recession hits, you will have the luxury of being able to pay for medical bills, if you have a job. You will also get to see your healthcare provider prior to the hard times that loom, because you are, more than likely, still employed. And while health is still on your mind, make sure you refill various prescription drugs, while pharmacies are still open and you can get your prescriptions drug refills, as needed. If you use a flexible healthcare spending account, when a recession is looming is a good time to learn how long it covers you for, if there indeed is ever a good time.

It's a pretty good idea to buy used products without the threat of a recession, but a recession amplifies the reasons why. Brand new products are more expensive than used shirts, cars and, so on. Given the likelihood that you'll lose your job shortly after a recession hits, if you have any knowledge of the economy, things might not necessarily be scarce, but the odds are against you in regards of whether you will stay employed or not. Without a job, you no longer have the luxury of buying a brand new Mercedes Benz, if you're part of the middle class. And it is relatively easy to find the products you are looking for, and their quality might be almost the same as when the product was new, and the products are at much more reasonable prices, as far as a price before or in a recession hits. In a nutshell, better prices, and it's likely that the quality is still good.

You might be asking what cleaning your house has to do with preparing for a recession. Well, usually, it has absolutely nothing to do with preparing for a recession, but if you start looking for ways to rid your home from clutter, not only does it look good, but by getting rid of clothes, video games, toys, and other things that you haven't touched in years, and probably forgot you had to begin with, it also provides a decent source of money for you, and helps lessen the blow when a recession hits. And if you take the focus off of yourself, and look at the big picture, whoever the recipient may be might have needed your junk way more than you do. Kindness and a decent source of money wrapped in one. It will possibly be more than just you and your family who you are helping.

I know it was just a mistake but I like to imagine this means a garage "sell" I.e. selling your garage while you still own the rest of the house which would be an odd thing to do but maybe if you didn't need a car it would work.

Well, yes, that's actually a decent approach to prepping for a recession. It's all about getting money safely in your wallet in advance, really. Cash is King and all.

As the economy crashes, as it unfortunately should during a recession, if there's one thing that can be considered a positive, it's that your power as the customer goes up tremendously. The worse the economy gets, the more likely you will get to try to negotiate for a better deal for whatever you might be buying. Be bold and ask for a lower price or bonuses for whatever the product may be. You may not be a great negotiator off the cuff, as it takes a business know-how and experience to do good negotiations, usually. Not only will customers you get to try to negotiate, but for the most part, whatever store you are trying to negotiate a price with will be willing to find a middle ground, more often than not. Businesses will try to raise their price in desperate times, but you can ask for a lower price just as much.

Saving money when buying from Amazon and other online sources becomes much easier when you install apps that search for coupons for you, so you don't have to. Apps like Groupon and PayPal are critically acclaimed economic assistance, and many find the deals that they get from these apps as great. Put into consideration a recession, and the app store or the Google Play Store can be live saving. Groupon is the most popular example and over 100 million people use it, and the vast majority give it a five star rating for good deals and better prices. Other apps, like CouponCabinet and RetailMeNot provide the same concept. They search the Internet whenever you're about to finish making an online purchase and will search for any coupon codes that are legal, available, and so on. People already think these apps are wonderful, but in a recession, or perhaps a little bit before one, they would feel ten times better, if not more, considering the circumstances.

While it's another way to save money, how do you expect to get to work, with the assumption that you still have a job, after a while?

Because if you're switching to a job in which you have much less credibility than in your current job, you're more likely to get fired in the new job.